Financials

Half-Yearly Financial Statement And Dividend Announcement 2024

Financials Archive![]() Note: Files are in Adobe (PDF) format.

Note: Files are in Adobe (PDF) format.

Please download the free Adobe Acrobat Reader to view these documents.

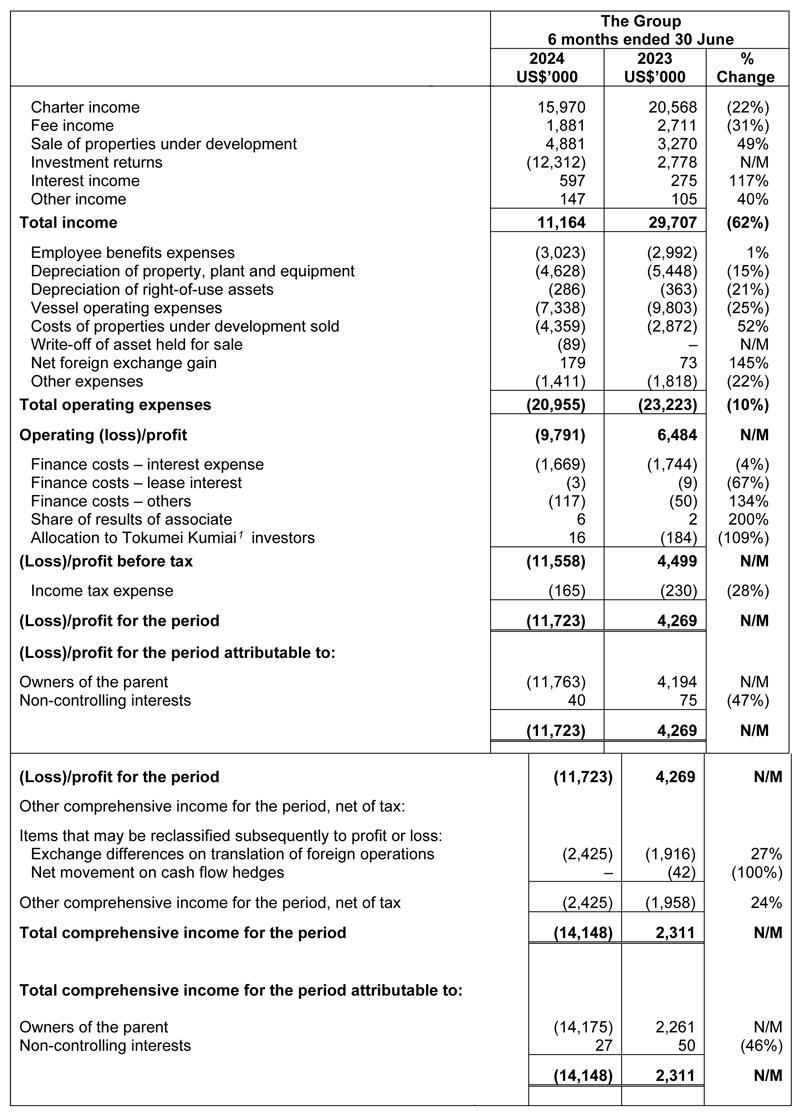

CONDENSED INTERIM CONSOLIDATED STATEMENT OF PROFIT OR LOSS FOR THE SIX MONTHS ENDED 30 JUNE 2024

1Tokumei Kumiai (“TK”) refers to a form of silent partnership structure used in Japan. Allocation to TK investors refers to share of profit

and loss attributable to other TK investors of the TK structure.

N/M: Not meaningful

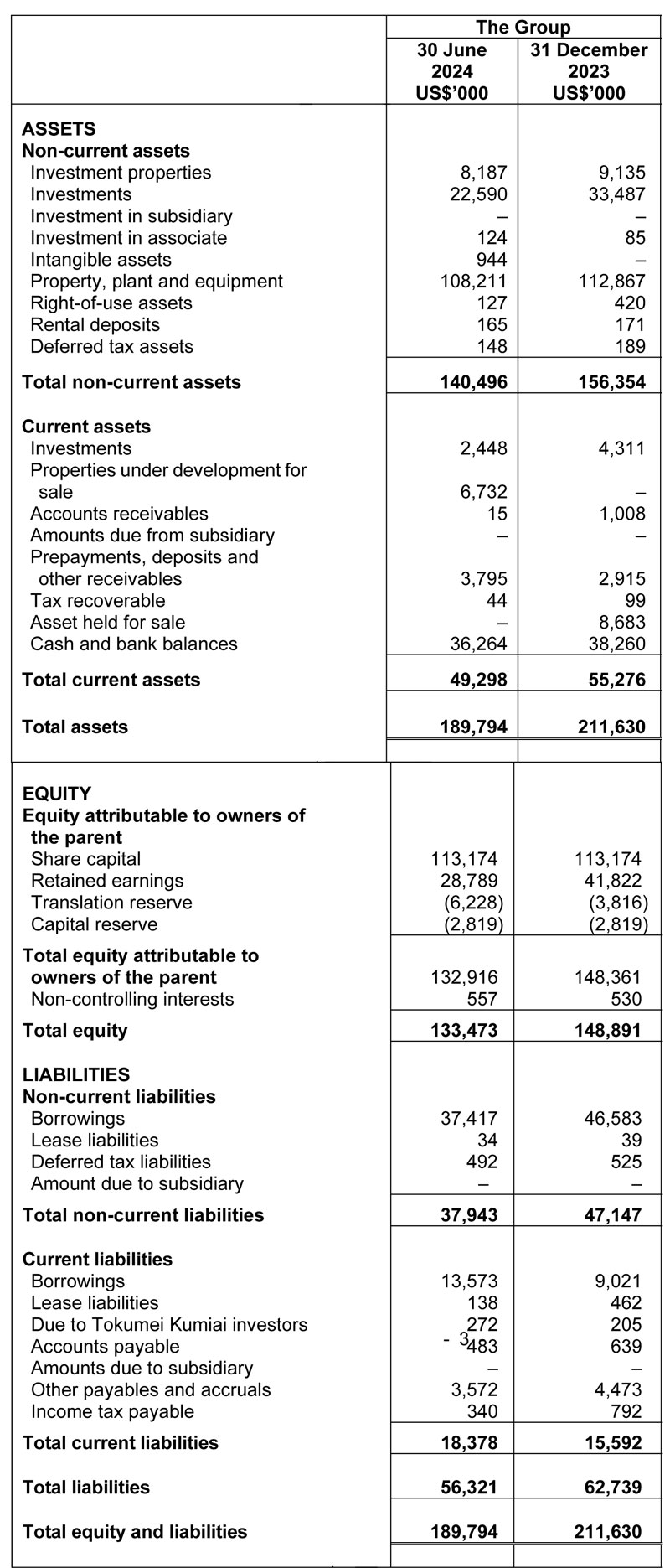

CONDENSED INTERIM STATEMENTS OF FINANCIAL POSITIONS AS AT 30 JUNE 2024

Review of Performance

REVIEW OF CONSOLIDATED STATEMENT OF PROFIT OR LOSS

Total Income

Total income of the Group was US$11.2 million for the period ended 30 June 2024 (“1H2024”), a 62% decrease from US$29.7 million for the period ended 30 June 2023 (“1H2023”). Changes in major components of total income, including charter income, fee income, sale of properties under development, investment returns, interest income and other income are explained below.

(i) Charter Income

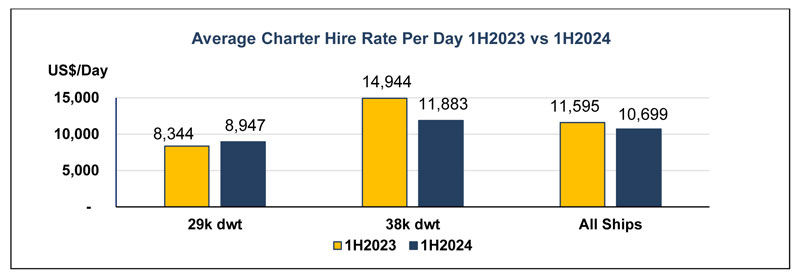

Following the sale of the Group’s two oldest 29k dwt dry bulk carriers, the Group has three 29k dwt dry bulk carriers and five 38k dwt dry bulk carriers as at 30 June 2024, compared to five each of 29k dwt and 38k dwt dry bulk carriers as at 30 June 2023.

As a result, total charter income decreased by 22% from US$20.6 million in 1H2023 to US$16.0 million in 1H2024.

However, as seen from the following, the average charter of the five 29k dwt ships in 1H2023 did not perform as well as the average charter of the five 38k dwt ships in 1H2023. With the disposal and improved market, the average charter of the remaining three 29k dwt ships improved in 1H2024. Notwithstanding, the average charter of the 29k dwt ships still drag down the average performance of the Group’s average charter.

(ii) Fee Income

Total fee income was US$1.9 million in 1H2024, a decrease of 31% from US$2.7 million in 1H2024. Please refer to Note 9 of Notes To The Condensed Interim Consolidated Financial Statements for breakdown of Fee Income for 1H2024 and 1H2023.

Recurring asset management and administration fee income for 1H2024 reduced by 15% from that in 1H2023. The contribution of Japan’s asset management fee income has increased, notwithstanding such increase in USD terms was eroded by the weakened JPY. However, the Group had deferred charging asset management and administration fees on co-investors’ Hong Kong property project investment due to the dismayed performance of Hong Kong property projects, resulting in a decrease.

Arrangement and agency fee decreased in 1H2024 due mainly to absence of significant arrangement fee income.

Brokerage commission decreased in 1H2024 by 70% as the Group had a one-off hotel-related brokerage deal in 1H2023 which was absent in 1H2024.

(iii) Sale of properties under development

A larger property under development project was sold for a total of US$4.9 million in 1H2024 compared to a small project sold for US$3.3 million in 1H2023, resulting in an increase of 49%.

(iv) Investment Returns

In 2010, the Group partnered with a private developer in Hong Kong to develop the Group’s first Hong Kong property project, with the partner taking a majority stake in the development consortium while the Group and other investors took up minority stakes. Following the success of the first project, the Group continued partnering with this developer using similar modus operandi and to-date invested in a total of 8 projects. For the first three projects, the Group invested a total of US$17.5 million and received total proceeds of US$42.7 million, netting a cash profit of approximately US$25.2 million.

However, Hong Kong faced several challenges since 2019, including the COVID-19 pandemic, causing Hong Kong’s commercial property market to deteriorate significantly. Notwithstanding Hong Kong Government’s recent new initiatives to attract international capital and talent, sales volume of Hong Kong commercial/industrial properties remained subdued. In light of the prevailing market conditions in the Hong Kong and Mainland China property market, completed construction projects in the region are facing declines in sales volume. In particular, a few large Mainland China developers have defaulted on their debt or are experiencing difficulties in meeting their debt and loan obligations. With continuing high interest rates and difficulties in selling the projects, there are indications that the Group may not be able to recover all capital should the consortium which the Group invests in were to sell the projects in the current market to meet the consortium’s debt obligations.

As a result, the Group has booked a fair valuation loss of US$12.8 million for its Hong Kong property project investments, having referred to IFRS 13 – Fair Value Measurement Para 89 and Appendix B Para B39 – B43 for guidance. The Group does not have any contingent liabilities (including guarantees) nor capital commitment relating to the Hong Kong property projects.

Excluding this US$12.8 million fair valuation loss, investment returns for 1H2024 was a gain of US$0.5 million compared to US$2.8 million for 1H2023, a decrease of 82%. This was because in 1H2023, the Group recognised realised gains of US$1.0 million from sale of investment property, and US$1.3 million from distributions from ship joint-investments, and no such realised gains were recorded in 1H2024.

Property rental income was US$0.3 million for 1H2024, compared to US$0.4 million for 1H2023.

Please refer to Note 10 of Notes To The Condensed Interim Consolidated Financial Statements for breakdown of Investment Returns for 1H2024 and 1H2023.

(v) Interest Income

With increasing interest rates, the Group recorded US$0.6 million interest income in 1H2024, an increase of 117% from US$0.3 million in 1H2023.

(vi) Other Income

No significant one-off miscellaneous income was received in 1H2024.

Total Operating Expenses

Employee benefits expenses remained around the same level in 1H2024 as 1H2023, at US$3.0 million. With 8 wholly-owned ships for 1H2024 compared to 10 wholly-owned ships for 1H2023, depreciation decreased by 15% from US$5.5 million in 1H2023 to US$4.6 million in 1H2024, and vessel operating expenses decreased by 25% from US$9.8 million in 1H2023 to US$7.3 million in 1H2024. Costs of properties under development sold were US$4.4 million for 1H2024 compared to US$2.9 million for 1H2023 because the project sold in 1H2024 was a bigger project.

No significant foreign exchange was recognised in 1H2024 as the Group did not have any significant nonUSD foreign currency exposure for 1H2024. Translation adjustments for the Group’s foreign subsidiaries are taken to reserves and not income statements.

Due to the aforementioned, net operating expenses decreased by 10% from US$23.2 million in 1H2023 to US$21.0 million in 1H2024.

Operating Profit

The Group recorded an operating loss of US$9.8 million for 1H2024 as operating profit was dragged down by the fair valuation loss of Hong Kong property projects.

Finance Costs and Other Costs

Interest on borrowings was US$1.7 million for 1H2024, around the same level as 1H2023.

Net Profit After Tax

The Group’s net loss after tax of for 1H2024 was US$11.7 million, compared to a profit of US$4.3 million in 1H2023.

Review of Statement of Financial Positions

Non-current assets

The Group’s non-current assets as at 30 June 2024 was US$140.5 million, a decrease of 10.2% compared to US$156.4 million on 31 December 2023.

Investments decreased by US$10.9 million mainly due to US$12.8 million fair valuation loss recorded for Hong Kong property investments, offset by new property investments in Japan.

Property, plant and equipment decreased by US$4.7 million due to depreciation.

Current assets

The Group’s current assets decreased by US$6.0 million from US$55.3 million on 31 December 2023 to US$49.3 million on 30 June 2024. Material variances are as follows:

- Decrease in short term investments of US$1.9 million from US$4.3 million on 31 December 2023 to US$2.4 million on 30 June 2024 mainly due to the Group increasing its stake in previously minority stake ALERO investments, upon which such projects are consolidated into the Group investments under Properties under Development for Sale;

- Increase in properties under development for sale to US$6.7 million on 30 June 2024 from nil on 31 December 2023 due to new projects as well as the Group increasing its stake in previously minority stake ALERO investments as mentioned in (1) above;

- Decrease in asset held for sale by US$8.7 million due to the disposal of the asset; and

- Decrease in cash and bank balances by US$2.0 million. Please see the following review of statement of cash flows for further information.

Total liabilities

Total liabilities decreased by US$6.4 million from US$62.7 million on 31 December 2023 to US$56.3 million on 30 June 2024. Material variances are as follows:

- Decrease in total borrowings (including both current and non-current) of the Group by US$4.6 million in 1H2024 mainly due to scheduled repayment of long-term borrowings; and

- Decrease in accounts payable/other payables and accruals/tax payables by US$1.5 million due to payment in 1H2024 of such payables and accruals accrued on 31 December 2023.

Review of Statement of Cash Flows

The Group’s cash and bank balances decreased by US$2.0 million in 1H2024 after the effects of foreign exchange rate changes. Material items are listed below.

- US$6.2 million was generated from operating activities in 1H2024, a decrease of US$1.5 million from

US$7.7 million in 1H2023. The decrease was mainly due to:

- reduction in net charter income as a result of the fewer ships in the portfolio; and

- absence of significant ad hoc fee income in 1H2024.

- Net cash inflows from investing activities were US$3.4 million in 1H2024.

Main cash inflows from investing activities include:

- Proceeds from redemption/sale of investments of US$0.9 million from sale of investments in Japan; and

- Proceeds from disposal of asset held for sale of US$8.6 million from the disposal of wholly-owned bulker – Uni Wealth.

Main cash outflows from investing activities were due to purchase of property-related investments in Japan of US$6.4 million.

- Cash flows used in financing activities were US$10.6 million in 1H2024.

Main cash outflows from financing activities include:

- repayments of borrowings of US$9.1 million offset by proceeds from borrowings of US$1.8 million;

- interest and other finance cost paid of US$1.8 million; and

- FY2023 final dividend of US$1.3 million.

Commentary

Dry Bulk

For 1H2024, average trading distances for ships had increased due to diversions from both the Panama Canal and Suez Canal. While diversions away from the Panama Canal were easing in 2Q2024, the continued conflict in the Middle East increased the diversions away from Suez Canal in response to Houthis attacks across the Red Sea.

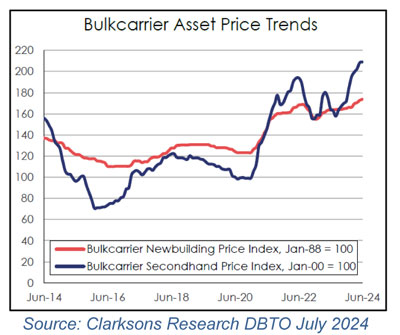

Meanwhile, demand for dry bulk carriers had increased in 1H2024, outstripping fleet expansion. To meet immediate demand rather than placing orders for new ships which will take a few years to deliver, dry bulk second-hand sales activity had increased.

As can be seen from the chart on the right (extracted from Clarksons Research Drybulk Trade Outlook July 2024 edition), the blue line representing bulkcarrier second-hand price index had increased significantly since June 2022, making it attractive for the Group to consider disposing the older 29k dwt ships. However, the high price is a hurdle for the Group to enter the market to purchase another ship.

In view of the above, the Group monitors closely the charter rates for its 38k dwt and 29k dwt ships in adoption of the most optimal mix of longer and shorter time charters. At the same time, the Group exercises close surveillance of the sale and purchase market with a view to monetising its older ships.

Japan Property

The Tokyo property market has been robust, driven by a combination of factors including a weak Japanese Yen and low interest rates. According to research by Daiwa Securities Living Investment Corporation, occupancy rate of residential properties in Tokyo 23-Wards as of May 2024 was at 97.43%, a sustained high rate since 2014. The Japan Real Estate Institute (“JREI”) published its April 2024 JREI Home Price Index on 25 June 2024, which showed that the index for the Tokyo Metropolitan Area increased for four consecutive months to 121.23 for April 2024, an increase of 4.6% as compared with the previous year. JREl’s same index for Tokyo was at 137.49 for April 2024, an increase of 6.2%.

While the Group is encouraged by the nine new ALERO projects in 1H2024, it continues to be difficult to identify new reasonably priced land for the Group’s ALERO projects. However, the Group has expanded its asset management expertise in Japan to include private finance initiative (“PFI”) projects, solar power plants, group homes, and other assets with a sustainability angle. The Group would also look for new property investment opportunities outside of Tokyo so as to diversify its Japan property portfolio.

Hong Kong Property

The Hong Kong commercial office/industrial property market continues to be subdued with various negative factors continuing to weigh on investor sentiment and transaction volumes, and thus price. Distressed or discounted assets deals have started gaining favour. The Group remains poised to explore possible opportunities in this area.