%XLOGLQJ 8S )XQGDPHQWDOV r DQQXDO UHSRUW

10

GROUP FINANCIAL REVIEW

TOTAL INCOME

7RWDO LQFRPH RI WKH *URXS ZDV

PLOOLRQ IRU )<

D

LQFUHDVH IURP )< &KDQJHV LQ PDMRU FRPSRQHQWV

of total income, including charter income, fee income, hotel

income and investment returns are explained below.

(I) CHARTER INCOME

&KDUWHU LQFRPH LQFUHDVHG E\

IURP PLOOLRQ LQ

)< WR

PLOOLRQ LQ )<

,Q )<

YHVVHOV

under the Group’s ship owning subsidiary, Uni-Asia Shipping

Limited contributed to charter income. The delivery of 2

newvessels in February 2015andMarch2015 increased the

ƯHHW VL]H RI GU\ EXON FDUULHUV RZQHG E\ 8QL $VLD 6KLSSLQJ

Limited to 8 as at 31 December 2015, thereby increasing

WKH FKDUWHU LQFRPH IRU )<

)XUWKHU D FRQWDLQHUVKLS

acquired in April 2015 by the Group also contributed to the

increase in charter income. The increase is in line with the

Group’s strategy to build up recurring charter income.

(II) FEE INCOME

7RWDO IHH LQFRPH LQFUHDVHG E\ WR PLOOLRQ LQ )<

IURP PLOOLRQ LQ )<

Asset management and administration fee remained fairly

VWDEOH LQ )< DV FRPSDUHG WR )<

$UUDQJHPHQW DQG DJHQF\ IHH LQFUHDVHG E\

WR

PLOOLRQ LQ )< IURP PLOOLRQ LQ )< GXH PDLQO\

WR GHDOV FORVHG LQ )<

(III) HOTEL INCOME

$YHUDJH -DSDQHVH <HQ H[FKDQJH UDWH DJDLQVW 86 'ROODUV

IRU )< GHSUHFLDWHG DURXQG

FRPSDUHG WR WKDW

RI )<

7KH GHSUHFLDWLRQ RI -3< UHVXOWHG LQ DQ LQFUHDVH

in visitors to Japan. This pushed up occupancy and daily

room rates across most hotels in Japan. The Group’s hotels

EHQHƭWHG IURP VXFK LQFUHDVH LQ RFFXSDQF\ DQG GDLO\ URRP

UDWHV ,Q -DSDQHVH <HQ WHUPV WKH *URXSoV KRWHO LQFRPH

LQFUHDVHG IURP -3< ELOOLRQ LQ )< WR -3< ELOOLRQ

LQ )<

+RZHYHU GXH WR GHSUHFLDWLRQ RI -DSDQHVH <HQ

against US Dollars, the Group’s hotel income in US Dollars

WHUPV UHGXFHG E\ IURP PLOOLRQ LQ )< WR

PLOOLRQ LQ )<

(IV) INVESTMENT RETURNS

,Q )< WKH *URXS UHFRJQLVHG PLOOLRQ IDLU YDOXDWLRQ

losses from shipping portfolio due to the depressed

shipping market. On the property segment, the Group

disposed of some of its investments from its hotel and

UHVLGHQWLDO SRUWIROLR LQ -DSDQ UHVXOWLQJ LQ D FODVVLƭFDWLRQ RI

realised gain on investment in hotel and residential while

reversing fair value adjustments previously recognised

IRU WKH VDPH LQYHVWPHQWV ,QYHVWPHQW UHWXUQV ZDV

PLOOLRQ IRU )< D GHFUHDVH RI

IURP )<

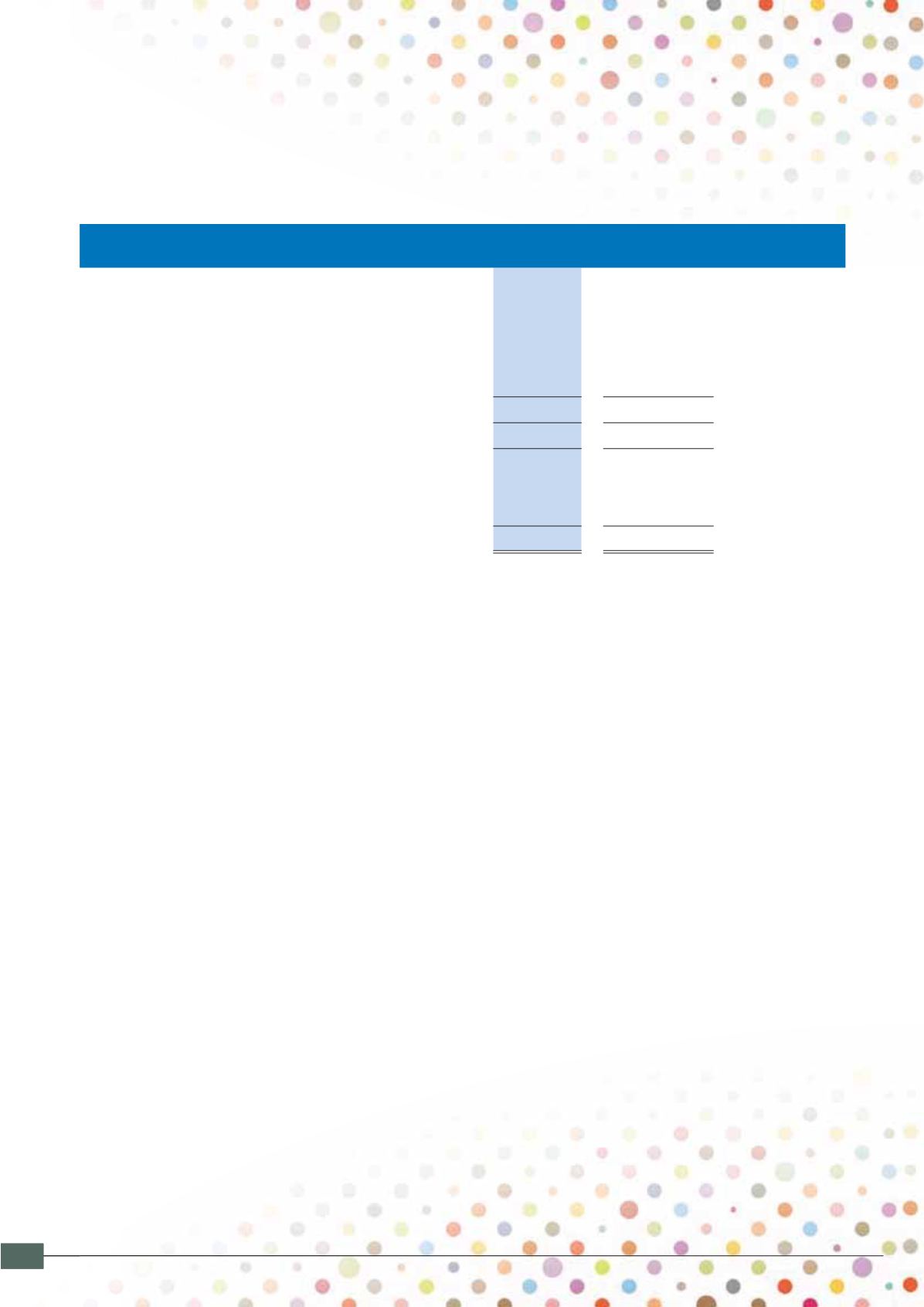

Selected Data

)<

86 o

)<

86 o

Change

Charter Income

30,465

19,396

Fee income

7,796

6,729

Hotel income

33,345

34,971

Investment returns

3,961

4,672

Interest and other income

1,485

1,366

Total income

77,052

67,134

Total operating expenses

(68,145)

(61,522)

2SHUDWLQJ SURƭW

8,907

5,612

3URƭW EHIRUH WD[

3,900

3,249

Income tax expense

(380)

(1,141)

3URƭW IRU WKH \HDU

3,520

2,108

1. GROUP FINANCIAL PERFORMANCE